Are you looking for a USDA Loan in Texas, but just not sure what a USDA loan is, how it works, or what it’s even about?

Well, looks like you’re in luck today.

We are one of Texas’s leading USDA lenders that specialize in providing FREE USDA mortgage advice and information to folks looking to learn more about how USDA loans work.

Whether you are looking to learn more about how much you can get approved for or already have a USDA mortgage and need to refinance out of your high-interest-rate loan, we’re here to help you every step of the way!

Please get in touch with Danny Nassar for rate details.

We don’t check credit, nor do we need your social security number to get started.

How Can a USDA Loan Help You?

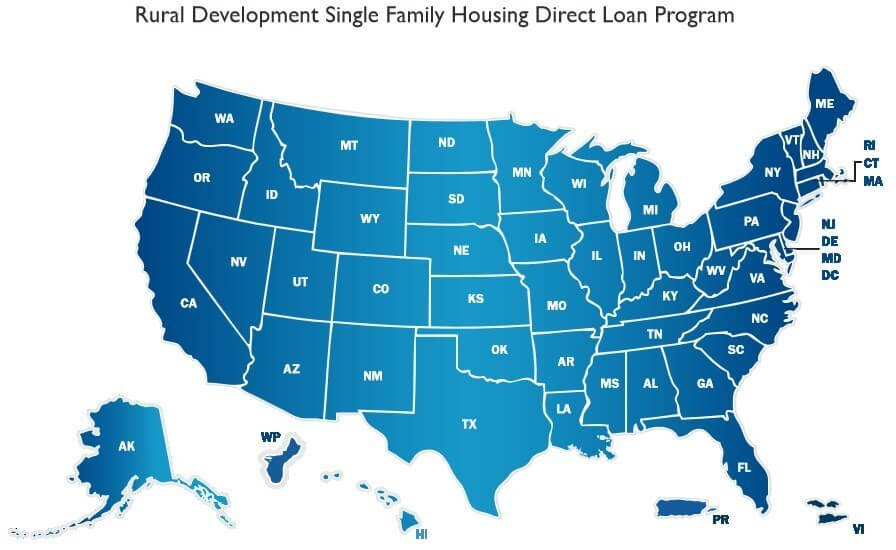

USDA loans in Texas are offered to help low to moderate-income households purchase homes in rural areas.

In Texas, a USDA loan offers many advantages to qualified borrowers looking to buy or refinance (no cash out), including:

We look forward to answering all your questions.

USDA/FDA Loans

Exciting things are happening with USDA home financing – other than a VA loan, USDA is only 1 of the few options left for actual 100% financing.

We specialize in servicing first-time home buyers looking for a USDA mortgage loan in Texas. A USDA mortgage offers many advantages,

In 2026, owning a home is a huge responsibility that shouldn’t be taken lightly when you’re looking at FDA loans. There is a lot to learn before you dive right in, although the first step is often to get approved for FDA home loans. People who have taken mortgages in the past have contributed their knowledge to this article, so you can learn how to avoid the mistakes they’ve made. Read about the Rural Development Direct Loan Program

100% Financing

Funds for Closing

Another great feature that comes along with USDA financing is that you can roll everything into the loan. This means you can include closing costs, the guarantee fee, title service fees, and other prepaid expenses, as long as the appraised value is higher than the sales price. This is done by having the sellers raise the sales price by a certain percentage and then giving it back to you to help contribute to your closing costs.

Occupancy

USDA home loans are only for primary residences. All buyers must personally occupy the dwelling following the purchase.

Refinance Options

If you want to refinance into a USDA loan, you must have an existing USDA Rural Development Guaranteed housing loan or our Section 502 Direct housing loan already in place. For example, you cannot refinance into a USDA loan if you currently have an FHA loan.

Guarantee Fee

There is a one-time guarantee fee charged to the lender, which is then rolled into the loan. This is what is known as the USDA Guarantee fee, which helps keep the USDA in business and enables it to offer this great program.

If you are looking for an Austin USDA Lender, Houston USDA Lender, Dallas USDA Lender, or San Antonio USDA Lender, you have come to the right place!

USDA Loan Limits 2026

These are the loan limits for the USDA direct program. Please keep in mind that these are the limits if you go directly with the USDA. However, if you work with a USDA-approved lender, such as us, these limits are significantly higher because the lender is assuming the risk instead of USDA itself.

To put things in perspective, USDA lenders like us can do loan amounts over $400,000 whereas if you decide to go with the USDA direct mortgage loan program, you will be capped at these limits below.

Here are all the counties and cities sorted out for you, nice and neat.

Hire an attorney to help you understand your USDA loan income limits and property limits. Even those with degrees in accounting can find it difficult to fully understand the terms of a mortgage loan and the different types of rural development income limits, and just trusting someone’s word on what everything means can cause you problems down the line. Get an attorney to look it over and make everything straightforward on the USDA loan limits.

USDA First Time Home Buyer

A rural development loan is just another way of saying a USDA mortgage. Both are, in fact, the same thing, but different lenders use this terminology instead.

USDA home loans for rural housing are designed to keep agricultural areas in the United States strong by giving people in the communities the same opportunity to own homes, even though there may be fewer homes in these USDA areas.

Our USDA loan experts will walk you through the process of obtaining a USDA loan in Texas.

[/su_green_checklist]Purpose

The USDA Rural Development Loan program is made to ensure that individuals in rural communities can compete in the global economy. This will enable rural communities to build community centers and facilities, thereby attracting more people to move to those neighborhoods. These loans are attractive to those who have stable income and credit, but don’t have enough money for a down payment.

Benefit

Traditional mortgage loans can be more challenging for these types of buyers because they require a down payment and do not have a guarantee that the loan will be paid. USDA home mortgage loans, on the other hand, are insured and guaranteed by the government.

Protection

Under the Guaranteed Loan Program, the Housing and Community Facilities Program guarantees and insures loans made by lenders such as ourselves. In addition, an individual or family may borrow up to 100% of the appraised value of the home, which eliminates the need for a down payment.

Location

Not only do people living in rural areas qualify. Those living on the outskirts of a city or in a medium-sized town may also qualify. Find out if you qualify for a USDA home mortgage loan by asking questions without any obligations.

Outlook

USDA loans in Texas are primarily designed to help low-income individuals and households purchase a home in rural areas. These loans do not require a down payment but do have income and property limitations.

If you are planning on purchasing a house and are a USDA first-time home buyer, make sure your credit is in good standing. Most lenders want to make sure your credit history has been spotless for at least a year if you’re looking to get approved for a USDA first-time home buyer loan.

Additionally, you can take advantage of the USDA First-Time Home Buyer Grant, which assists.

USDA Refinance

If you are looking to refinance and want the best rate and terms, and want an easy process with more favorable guidelines, a USDA loan is probably the best choice for you.

USDA refinances are for rate and term refinance loans (no cash out allowed). The original loan must be a Guaranteed Rural Housing Loan.

USDA fixed-rate loans are one of the most popular programs for refinancing. This is where you have stable, predictable payments each month, and as a result, it offers the most security for yourself and your family. If you are currently in an adjustable rate mortgage (ARM) and would like the security of a fixed rate, a fixed rate USDA is the right program for you.

Refinancing Your USDA Loan

Refinancing into a USDA loan is a very similar process to refinancing using conventional financing.

In fact, both loans require almost identical paperwork; it’s just that a USDA mortgage is another type of loan.

That whole process generally takes no more than 30 days.

One nice advantage of refinancing is that you are allowed to skip one month of your mortgage payment after you close.

Depending on when in the month your mortgage closes, you may not be able to make the current mortgage payment and may also incur the following month’s payment. You can use this money to pay off another bill, fix up your home, or even go on vacation.

When it comes to refinancing your current Texas USDA mortgage, we make the process simple by giving you straightforward advice, because we know that this will enable you to make the most accurate financial decision.

Please get in touch with Danny Nassar for Rates

USDA Mortgage Insurance

Although using money given to you as a gift from relatives for your down payment is legal, make sure to document that the money is a gift. The lending institution may require a written statement from the documentation and donor about when the deposit to your bank account was made. Have this documentation ready for your lender if you’re looking for a home loan directly.

USDA Underwriting Guidelines

To be eligible, applicants must:

- Have an adequate and dependable income.

- Be a U.S. citizen, qualified alien, or be legally admitted to the United States for permanent residence.

- Have an adjusted annual household income that does not exceed the moderate income limit established for the area. A family’s income includes the total gross income of the applicant, co-applicant, and any other adults in the household. Applicants may be eligible to make specific adjustments to gross income—such as annual child care expenses and $480 for each minor child—to qualify. Here is an automated USDA income eligibility calculator for USDA to help out.

- Have a credit history that indicates a reasonable willingness to meet obligations as they become due.

- Have repayment ability based on the following ratios: total monthly obligations / gross monthly income cannot exceed 41%.

When comparing USDA direct vs guaranteed loans in 2026 and before giving personal information to any lender, check with your local Better Business Bureau. Unfortunately, there are predatory lenders out there that are only out to steal your identity. By checking with your BBB, you can ensure that you are only giving your information to a legitimate home mortgage lender.

USDA Property Eligibility

Considering a home purchase in Texas, but unsure about the down payment? The USDA Home Loan program, backed by the U.S. Department of Agriculture, offers a unique opportunity for 100% financing in eligible areas.

You might be surprised to learn that many areas outside major cities, and even some suburban neighborhoods, qualify for USDA financing. This program aims to strengthen rural and suburban communities by making homeownership more accessible.

As a leading Texas USDA loan specialist, we provide expert guidance and clear information to help you understand the program, determine your eligibility, and navigate the home-buying process with confidence.

Find out if you might qualify in under 30 seconds. No credit check or Social Security number is required to start. [Check Eligibility Now Button]

What is a USDA Home Loan?

The USDA Rural Development Guaranteed Housing Loan Program is designed to help low-to-moderate-income households purchase homes in designated rural and suburban areas. If saving for a down payment is a challenge, a USDA loan could be the perfect solution.

USDA Loan Eligibility Basics:

Borrower Requirements:

- Income: Household income must meet USDA limits for the specific county (we can help you verify this). Income must be stable and dependable. Use the [USDA Income Eligibility Calculator Link] as a starting point.

- Citizenship: Must be a U.S. citizen, qualified alien, or legally admitted for permanent residence.

- Credit: A reasonable credit history demonstrating a willingness to meet financial obligations is required. A credit score of 640+ is generally preferred for streamlined processing, but applications with lower scores may be considered with compensating factors.

- Repayment Ability: Your total monthly debt obligations (including the proposed mortgage payment) generally cannot exceed 41% of your gross monthly income (Debt-to-Income ratio).

Property Requirements:

- Location: The home must be located in a USDA-eligible rural or suburban area. [USDA Property Eligibility Map Link] You might be surprised which areas qualify – always check with us!

- Property Type: Must be a primary residence. Eligible properties typically include single-family homes and approved condominiums.

- Condition: The home must be structurally sound, functionally adequate, and in good repair.

- No Income Production: The property cannot be used for income-producing activities (e.g., a working farm).

Understanding USDA Loan Limits (Guaranteed Program)

The USDA Direct Loan program (administered directly by USDA) has strict loan limits. However, the USDA Guaranteed Loan Program, which is offered through approved lenders like us, does not have a maximum loan amount set by USDA. Instead, the loan amount is determined by the borrower’s repayment ability and the property’s value. We regularly process USDA loans significantly higher than the Direct program limits, often exceeding $400,000 based on borrower qualifications.

USDA Refinance Program

Already have a USDA loan? You may be eligible to refinance into a lower interest rate with the USDA Streamline Refinance program. This option offers simplified documentation and potentially eliminates the need for a new appraisal.

- Eligibility: Must currently have a USDA Guaranteed or Direct loan. Refinance is for rate-and-term changes only (no cash out).

- Benefits: Potentially lower your monthly payment and the total interest paid over the life of the loan.

The USDA Loan Process with Us:

- Eligibility Check: Start with our quick online tool or contact us directly.

- Pre-Approval: We’ll review your income, credit, and financial details to determine your potential loan amount.

- Application: Complete the formal loan application using our secure online portal.

- Processing & Underwriting: We gather necessary documentation (pay stubs, bank statements, etc.) and submit your file for USDA review and approval.

- Appraisal: An independent appraisal is ordered to confirm that the property’s value and condition meet USDA standards.

- Closing: Once final approval is received, you’ll sign the closing documents, and the keys to your new home are yours!

Using Gift Funds:

If you receive gift funds from eligible donors (like family) to help with closing costs, ensure you have clear documentation. This typically involves a gift letter from the donor confirming the funds are a gift and not a loan, along with proof of the funds transfer. We can guide you on the specific documentation needed.

Understanding Your Loan Estimate and Closing Costs:

Once you apply and provide the necessary information, you’ll receive a Loan Estimate (LE). This standardized document outlines the estimated costs associated with your loan, including lender fees, third-party charges (such as appraisal and title insurance), and prepaid expenses (like property taxes and homeowners’ insurance). We are committed to transparency and will walk you through your LE to ensure you understand all associated costs before closing.

Escrow for Taxes and Insurance:

Most mortgages, including USDA loans, utilize an escrow account. A portion of your monthly payment goes into this account, and we use these funds to pay your property taxes and homeowner’s insurance premiums on your behalf when they are due. This ensures these essential bills are paid on time.

USDA Mortgage Calculator

Estimate your potential monthly payment, including principal, interest, taxes, insurance, and the USDA annual fee, using our specialized calculator. [Access the USDA Loan Calculator Link/Button]

USDA Loan Rates

Please get in touch with Danny Nassar. [Get a Personalized Rate Quote Link/Button]

Mortgage rates fluctuate based on market conditions.